Self employed payroll calculator

You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first 128400 of. Self employment taxes are comprised of two parts.

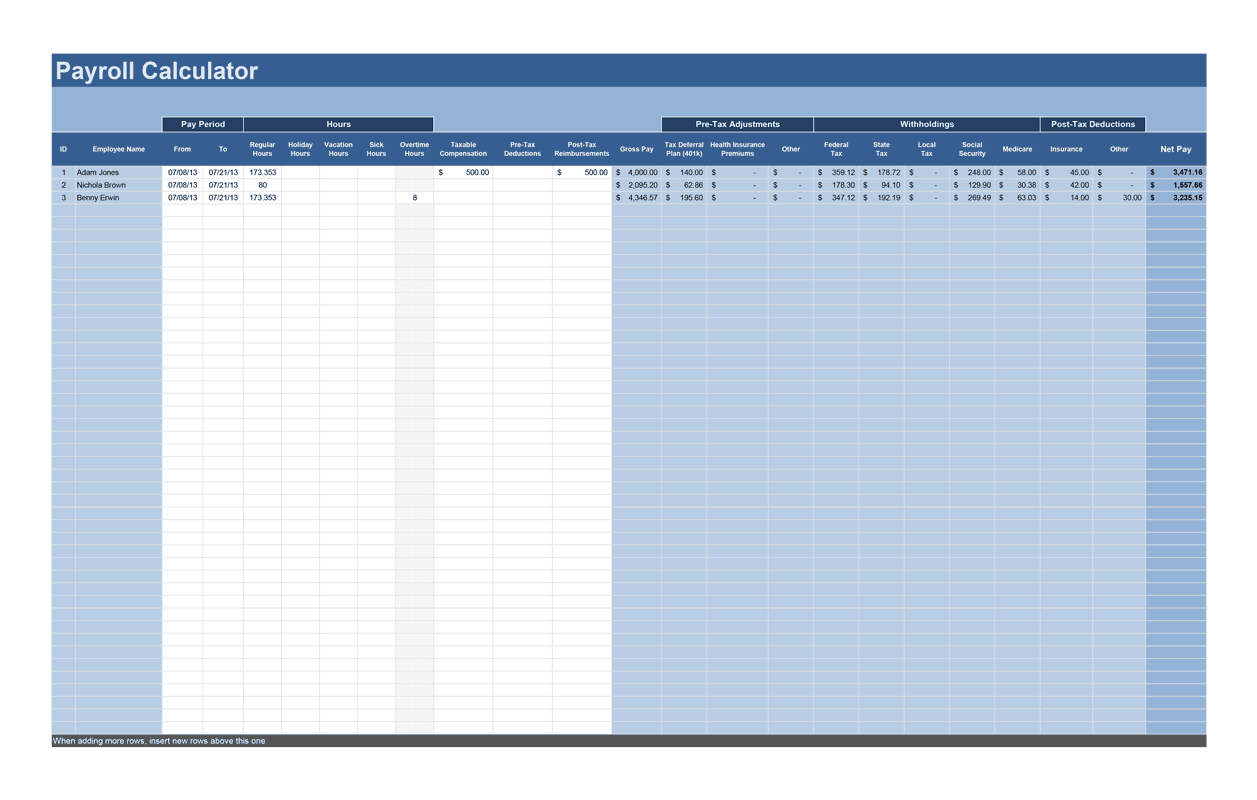

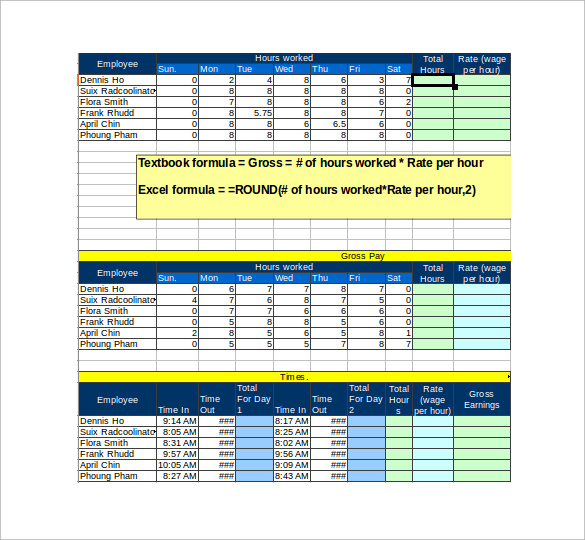

Payroll Calculator Free Employee Payroll Template For Excel

In 2022 income up to 147000 is subject to the 124 tax paid for the.

. Year to Date calculations You can add and customize the year. Calculate Business Payroll On The Go. This is your total income subject to self-employment taxes.

Our self-employed and sole trader income calculator. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. Read In-Depth Reviews Here.

Ad Compare This Years 10 Best Payroll Services Systems. Calculate your paycheck withholdings for free. They calculate your income by adding it up and dividing by 24 months.

Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. Use the IRSs Form 1040-ES as a worksheet to determine your. Ad Compare This Years Top 5 Free Payroll Software.

Ad Designed for small business ezPaycheck is easy-to-use and flexible. Enter your total employment wages and tips that you have been paid where Social Security taxes have been deducted. Free Unbiased Reviews Top Picks.

Ad Access Tax Forms. The Social Security portion has a limit on how much of your income is taxed currently 142800 or. Sponsored Links Sponsored Links Payroll Information.

Find More Time to Focus on Whats Important to Your Business. Taxes Paid Filed - 100 Guarantee. Employed and self-employed tax calculator.

Ad Easy To Run Payroll Get Set Up Running in Minutes. See what happens when you are both employed and self employed. You pay 7092 40 on your self-employment.

When you put together a business budget youll need to include the amounts you have to pay towards Tax and National Insurance NI. Taxes Paid Filed - 100 Guarantee. Our employed and self-employed calculator gives you an estimated income and national insurance.

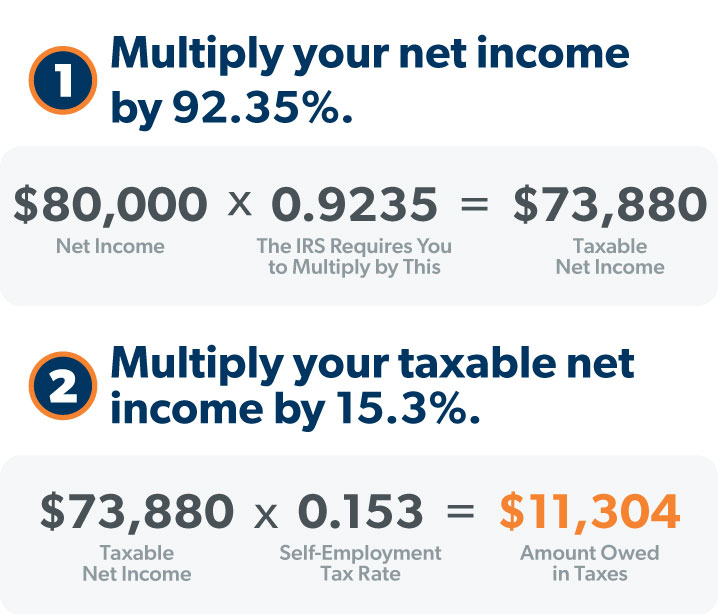

Self-employment tax consists of 124 going to Social Security and 29 going to Medicare. Free Unbiased Reviews Top Picks. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

All Payroll Services in One Place. Employed and Self Employed uses tax information from the tax year 2022 2023 to show you take-home pay. Social Security and Medicare.

Self-employed individuals generally must pay self-employment SE tax as well as income tax. Ad Search For Self Employed Payroll Calculator Now. Free Unbiased Reviews Top Picks.

This percentage is a combination of Social Security and Medicare tax. Ad Software That Fits Your Needs. Self-employed workers are taxed at 153 of the net profit.

The deadline is January 31st of the following year. Ad Easy To Run Payroll Get Set Up Running in Minutes. You will need to submit a Self Assessment tax return and pay these taxes and contributions yourself.

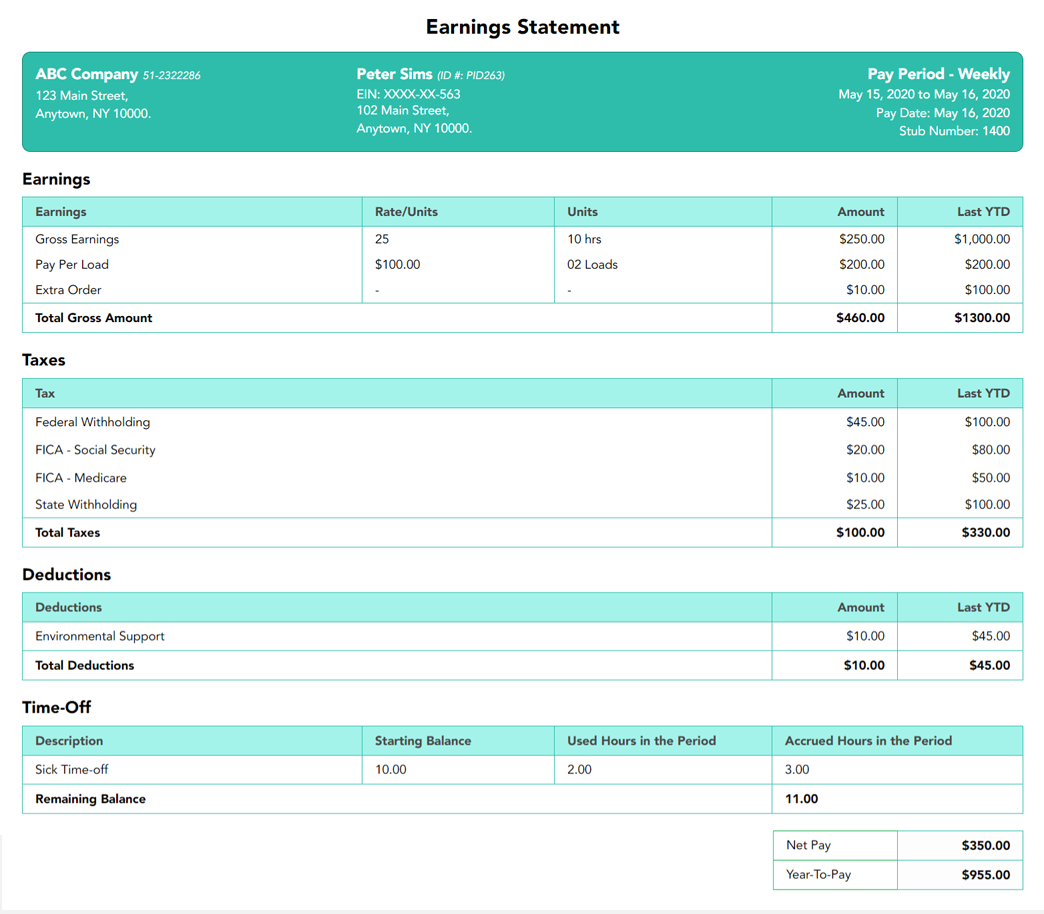

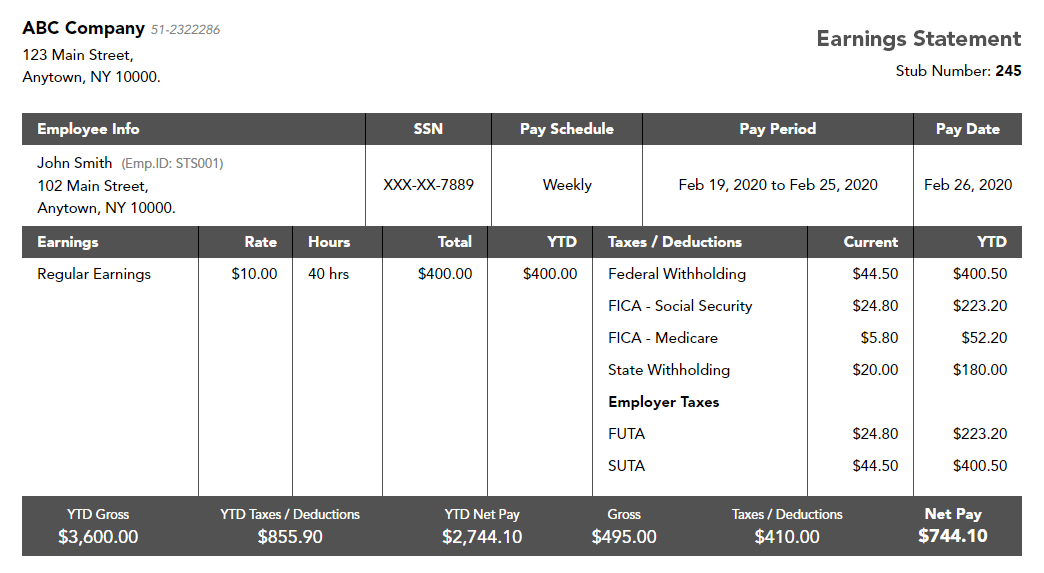

How do I calculate my monthly self-employment income. Our paystub generator is also a payroll tax calculator and an everyday payroll lifesaver trusted by many self-employed individuals. You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first 128400 of.

For example say year one the business. Self employment taxes are comprised of two parts. Employees who receive a W-2 only pay half of the total.

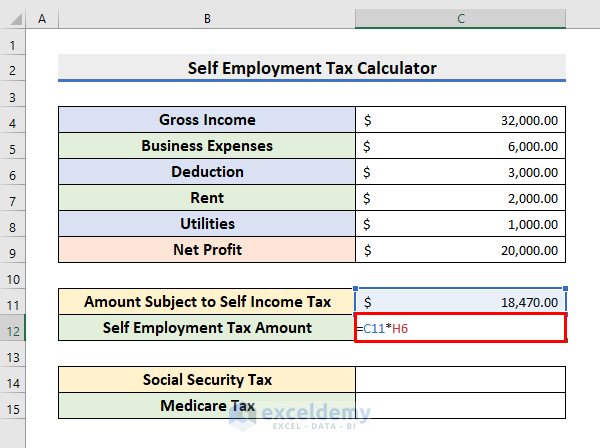

Calculate your adjusted gross income from self-employment for the year. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. Ad Compare This Years Top 5 Free Payroll Software.

Social Security and Medicare. This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income. Use this Self-Employment Tax Calculator to estimate your.

Whether youre employed self-employed or a combination of both working out your take home pay after tax can be tricky. Here is how to calculate your quarterly taxes. Self-employed contractors freelancers who sell their goods and services as sole proprietorships typically provide their own rates which can be hourly daily or.

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Payroll Calculator Free Employee Payroll Template For Excel

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Self Employment Ledger Forms Beautiful Printable Payroll Ledger Payroll Payroll Template Bookkeeping Templates

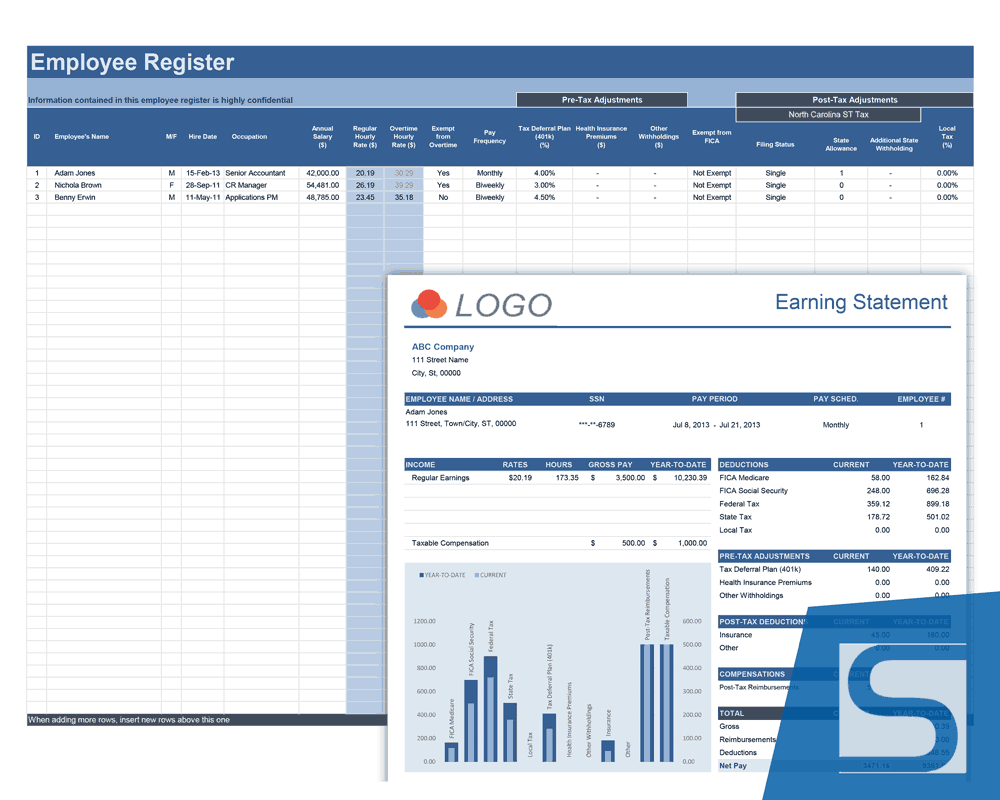

How To Manage Payroll Yourself For Your Small Business Gusto

Free Paystub Generator For Self Employed Individuals

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Paycheck Calculator Take Home Pay Calculator

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Payroll Template Bookkeeping Templates

Free Paystub Generator For Self Employed Individuals

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Llc Tax Calculator Definitive Small Business Tax Estimator

Self Employment Tax Calculator To Calculate Medicare And Ss Taxes